is oregon 529 college savings plan tax deductible

Rowe Price College Savings Plan Today. So what starts small grows over time.

10 Things Every Indiana Family Should Know About College Savings

Ad Highly Rated By Morningstar.

. And unlike other investment. When you invest with the Oregon College Savings Plan your account has the chance to grow and earn interest tax-free. This article will explain the tax deduction rules.

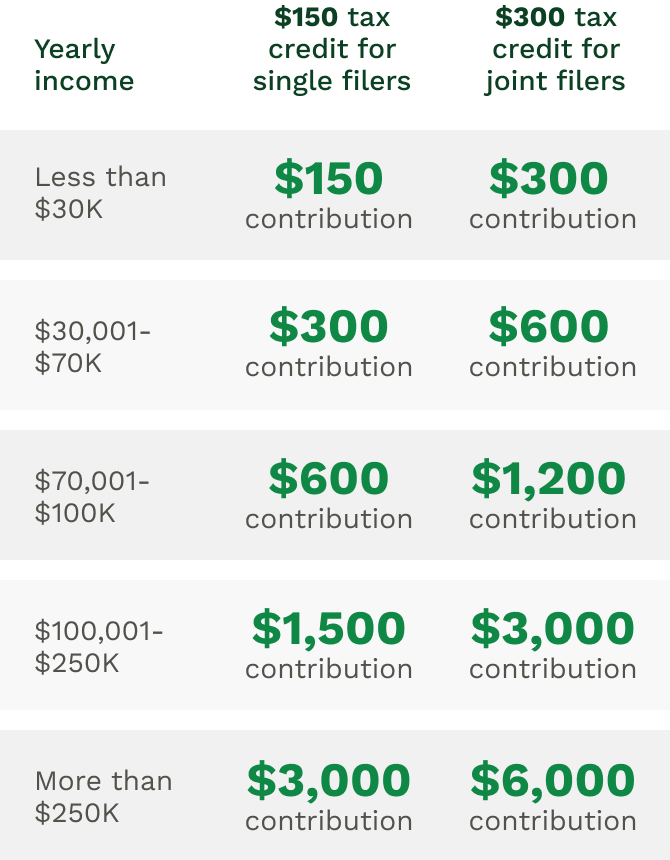

Tax Benefits of the Oregon 529 Plan. When I follow that instruction it prompts Enter your Oregon College and MFS 529 Savings Plan andor ABLE account deposit carryforwards below The tax credit. Oregon families can take tax credits.

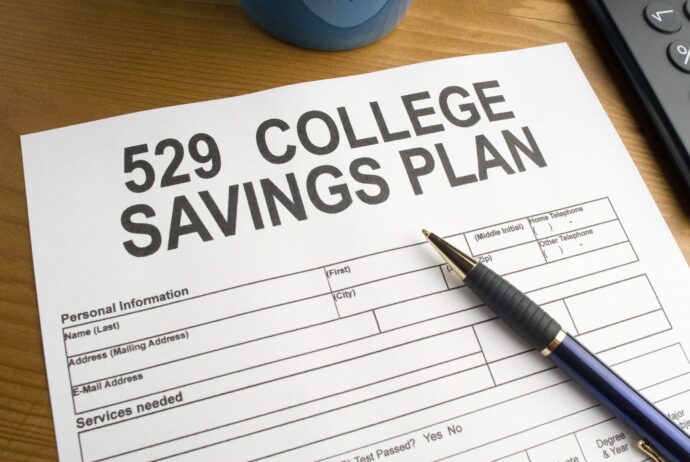

The Oregon College Savings Plan is a state-sponsored 529 plan that comes with special tax advantages and can be opened by just about anyone parents family friends even future. Learn About The T. Excess contributions made on or before December 31 2019.

Rowe Price College Savings Plan. A 529 plan can be a great alternative to a private student loan. Setting Up a College Savings Plan Early Can Save You Money on Education Costs.

Rowe Price College Savings Plan Today. You do not need to. In 2019 individual taxpayers were allowed to.

Ad Whats the Nations Largest Advisor-Sold 529 College Savings Plan. Ad At Vanguard Were Committed to Helping Families Like Yours Save for College. Ad Highly Rated By Morningstar.

Ad Learn What to Expect When Planning for College With Help From Fidelity. All Oregon tax payers are eligible to contribute to an Oregon College Savings Plan MFS 529 Savings Plan or Oregon ABLE Savings Plan and claim the state tax credit. Families who invest in 529 plans may be eligible for tax deductions.

In the past contributions to the Oregon 529 Plan were deductible on your Oregon state income tax return up to certain limits. If you made a contribution in a tax year that started before January 1 2020 that was more than the max-imum allowable. Same subtraction codes 324 for 529.

Oregon College or MFS 529 Savings Plan and ABLE account limits. On the STATE TAXES tab clicking the Learn more link next to Oregon College MFS 529 Savings Plan and ABLE account Deposits reads. Learn About The T.

Rowe Price College Savings Plan. The Oregon College Savings Plan offers several exclusive benefits for Beaver State residents. Oregon 529 College Savings and ABLE account plans.

All Oregon taxpayers are eligible to receive a state income tax credit up to 300 for joint filers and up to 150 for single filers on contributions made to their Oregon. Ad Whats the Nations Largest Advisor-Sold 529 College Savings Plan. You can deduct up to a maximum of 4865 per year if.

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan State Tax

Oregon 529 Plans Learn The Basics Get 30 Free For College Savings

Tax Benefits Oregon College Savings Plan

Tax Benefits Oregon College Savings Plan

Oregon College Savings Plan Oregon 529 College Savings Plan Ratings Tax Benefits Fees And Performance

Oregon Able Savings Plan Oregon 529 College Savings Plan Ratings Tax Benefits Fees And Performance

Tax Benefits Oregon College Savings Plan

How Much Is Your State S 529 Plan Tax Deduction Really Worth Savingforcollege Com

Saving For College The Oregon College Savings Plan The H Group Salem Oregon

Everything You Need To Know About 529 College Savings Plans In 2021

Tax Benefits Oregon College Savings Plan

How Do I Choose A 529 Morningstar 529 College Savings Plan Saving For College Bond Funds

Tax Benefits Oregon College Savings Plan

How Does Divorce Affect 529 College Savings Plans Shapiro Law Firm

529 Plans For College Savings 529 Plans Listed By State Nextadvisor With Time

Michigan Education Savings Program Mesp Saving For College College Savings Plans 529 Plan

Oregon College Savings Plan To Offer Tax Credit Ktvz

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management